Key Insights:

- XRP saw a 3% price increase on Nov. 28, reaching its highest level in two weeks amidst market rally.

- The token’s technicals show signs of weakness, including a death cross and descending channel, suggesting bearish momentum.

- Whale investors have sold over 460 million XRP, signaling profit-taking and further downside risk.

XRP price surged by 3% on November 28, hitting its highest point in over two weeks as the crypto market maintained its upward momentum. Despite this rise, analysts warn that the token could face a sharp reversal due to bearish chart patterns and continued whale activity. XRP’s price is currently navigating through a series of troubling technical indicators that suggest more downside may be in store.

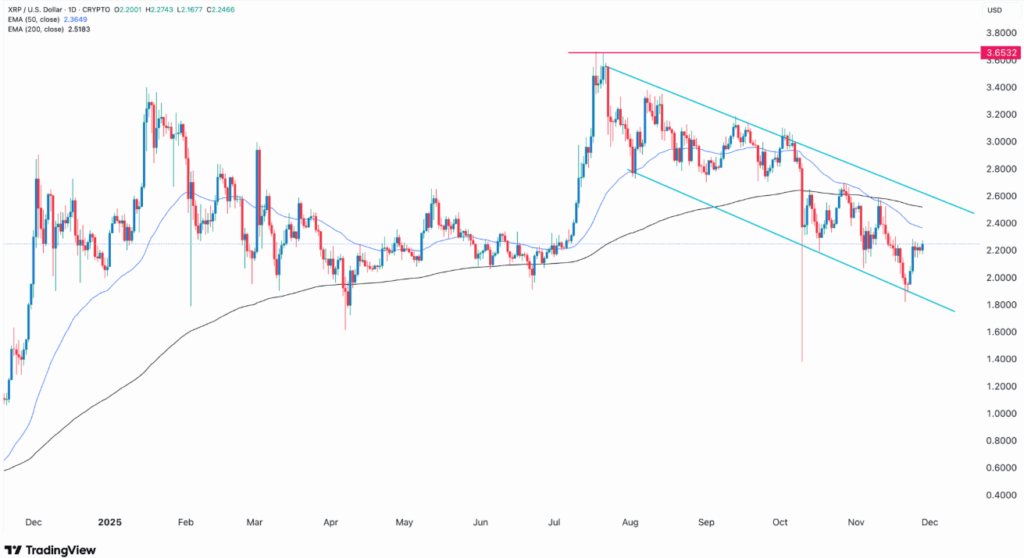

The daily chart for XRP shows a notable price rally of over 22% from its recent low, indicating a brief bull market. However, this surge follows a pattern of lower highs that have been forming since July. This includes key resistance levels in August, September, October, and November that failed to hold. Adding to the concern, XRP’s price has dropped below the Supertrend indicator, a common signal of continued bearish momentum in technical analysis. A bullish breakout would require the indicator to turn green, which has not occurred.

Death Cross Signals Potential for Further Decline

On November 6, the 50-day and 200-day Exponential Moving Averages (EMA) formed a death cross, a classic technical formation that often signals further downside. This formation occurred as the 50-day EMA crossed below the 200-day EMA, a typical sign of weakening momentum. XRP’s current price action also shows it is caught within a descending channel, reinforcing the bearish outlook.

Despite recent positive news surrounding Ripple, such as the approval of its stablecoin RLUSD in Abu Dhabi, whale investors have been unloading XRP tokens. Over the past four days, these large investors have sold more than 460 million XRP, worth over $1 billion at the current price. This wave of selling comes on the heels of Ripple’s recent ETF approvals, which have typically sparked profit-taking by major holders. Additionally, news of Ripple’s growth in the stablecoin space hasn’t been enough to stem the selling pressure.

XRP’s Path Ahead: Key Levels to Watch

Given the current market conditions, the most likely price action for XRP is further downside. A break below the lower bound of the descending channel could pave the way for more losses. The key psychological level to watch is $2, a significant point of support. On the flip side, a strong rally that pushes XRP above the 50-day and 200-day moving averages and the upper side of the descending channel would signal a potential recovery, possibly pushing the token toward its all-time high of $3.65.