Key Insights:

- The Supertrend indicator remains bearish, suggesting further downside risk for Binance Coin despite the recent 12% rebound.

- A potential death cross between the 50-day and 100-day EMAs points to a continuation of the bearish trend.

- DeFi metrics, including TVL and network activity, have sharply declined, further weakening the outlook for Binance Coin.

Binance Coin (BNB) has seen a 12% rebound from its lowest point this year, aligning with a broader recovery in the cryptocurrency market. However, the technical outlook suggests that this uptick may be temporary, as key indicators point to further downside risk.

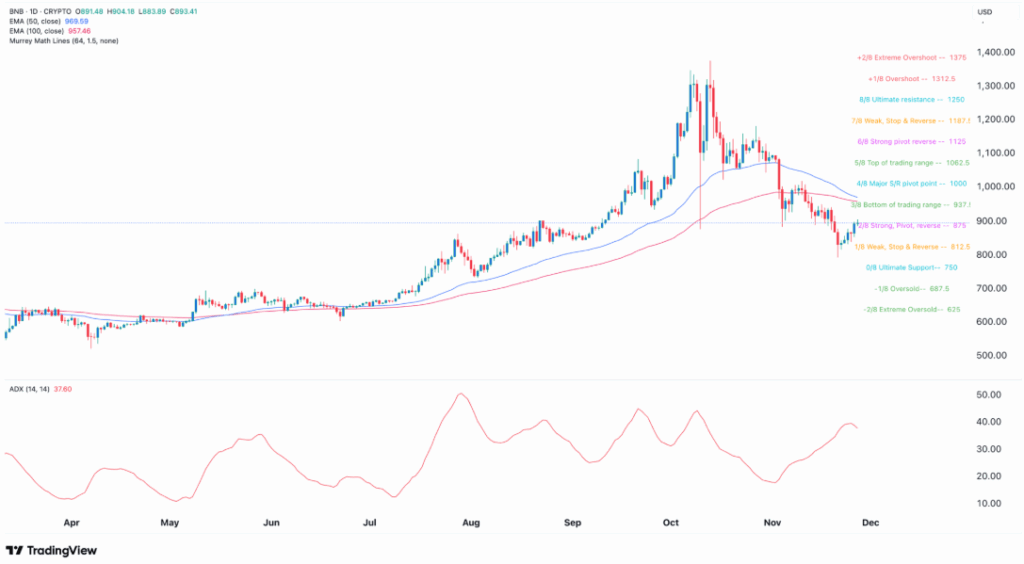

The Supertrend indicator, a common trend-following tool, remains in the red zone, signaling a bearish trend. This tool, which combines price action with volatility measurements, suggests the possibility of more downside in the coming weeks. Furthermore, the 50-day and 100-day Exponential Moving Averages (EMA) are on the verge of forming a bearish crossover. If this pattern fully develops, it would signal a mini death cross, historically a sign of further losses.

Declining ADX Indicates Weakening Momentum

Although Binance Coin has recovered recently, other indicators show signs of weakening momentum. The Average Directional Index (ADX), which measures trend strength, has dropped from a high of 41 to 37 this week, further suggesting a loss of bullish momentum. These technical factors align with concerns that the current price rebound may not hold.

BNB price has recently tested the $875 level, which is a critical pivot point according to the Murrey Math Lines tool. This level also marks the neckline of a potential double-top pattern, a bearish reversal signal. A break below this level could confirm further downside, with targets set at $750, the ultimate support of the Murrey Math Lines tool, and possibly even $625, an oversold level.

In addition to technical concerns, several key metrics of the Binance Smart Chain (BSC) ecosystem have shown notable declines. The number of active addresses on the network has dropped slightly to 3.6 million, and transaction volumes have plunged by 74% in the last 30 days, reducing network fees by 75%. This slowdown in activity could also impact Binance Coin’s burn rate and long-term value.

Declining TVL and Stablecoin Supply

Another concerning trend is the sharp decline in the total value locked (TVL) in decentralized finance (DeFi) applications built on BSC. TVL has fallen by 23% over the past month, dropping to $10 billion. Additionally, the stablecoin supply in the BSC network has dropped from a year-to-date high of $14 billion to $13.2 billion. These trends indicate that the Binance Coin ecosystem is facing significant challenges.