- PUMP trades inside a major high-volume node as sellers lose strength and price behavior steadies.

- Derivatives show rising open interest with neutral funding, suggesting cautious positioning before volatility.

- PUMP posts a 4.05% daily gain while remaining down 11.07% over the past week.

PUMP shows the market stabilizing around a dense value zone where buyers and sellers reset positioning. The asset trades within a high-volume support band that has shaped prior accumulation phases and softened earlier downside attempts.

Market Returns to Value as Price Meets High-Volume Support

The chart shows PUMP moving into a zone shaped by a long-standing horizontal demand band and a major high-volume node. This area acted as a base during earlier consolidation phases, attracting liquidity while slowing strong directional pressure. Altcoin Sherpa stated that this is “not the area you want to short,” which aligns with the current structure.

Price behavior reflects a transition from trending movement to value rotation. The earlier sequence of lower highs and lower lows has weakened near this base. Candles display tighter ranges and longer lower wicks, indicating reduced selling efficiency. A prior deep downside wick also shows that earlier selling pressure was absorbed quickly, reinforcing the boundary.

The visible range volume profile adds further clarity. The thick cluster on the right side represents a region where market participation was dense. Such nodes often act as magnets, drawing price toward them and limiting aggressive continuation. Current interaction with this HVN suggests stabilization rather than breakdown.

Derivatives Activity Points Toward Cautious Positioning

Derivative data reflects a market preparing for movement without directional clarity. Funding rates fluctuate around zero with little deviation. This shows a balanced market where neither buyers nor sellers are extending leverage aggressively.

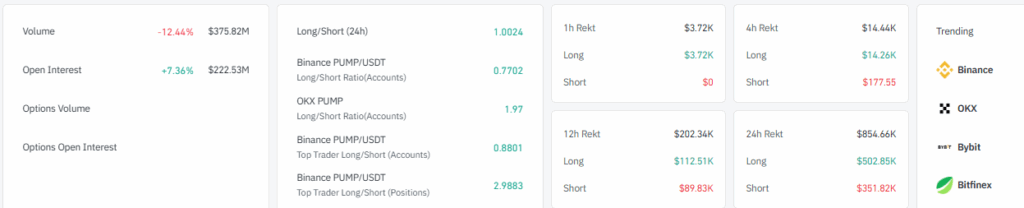

Open interest has climbed 7.36% to $222.53M while price stays range-bound. Rising OI during sideways trading often signals position building ahead of volatility. Funding rates remaining neutral while OI rises suggests measured participation rather than speculative chasing.

Volume has dropped 12.44% to $375.82M, indicating slower activity as traders take a wait-and-see approach. Liquidations in the past 24 hours totaled $854.66K, split between $502.85K in long liquidations and $351.82K in short liquidations. Trader ratios on Binance and OKX lean long, showing that larger accounts hold a mild preference for upward positioning.

Price Holds Steady as Traders Await Confirmation

PUMP as of writing, trades at $0.002719 after gaining 4.05% in the past 24 hours, though the asset remains down 11.07% over the past week. This mix of short-term strength and broader weakness matches its position within the current support structure.

The zone continues to act as an anchor where sellers lose traction and early signs of buyer interest emerge. A series of higher lows on lower timeframes could form the initial foundation for structure improvement. A reclaim of the nearby micro-range ledge above the HVN would offer the earliest constructive signal.

For now, conditions remain neutral. Traders watch to see whether this dense support zone sustains price and encourages renewed participation or whether a breakdown forms only with expanded volume and acceptance below the high-volume node.