- Avalanche’s $16 level continues to act as the key support shaping AVAX’s near-term trajectory.

- Trading volume fell by over 50%, signaling consolidation as investors await confirmation.

- New ecosystem integrations aim to strengthen community growth and network engagement.

Avalanche (AVAX) is stable around its long-term support of $16, which historically has been its market positioning since March. The existing form of the token shows that there is a stabilization period during which investors are tracking whether it will be able to stay on its feet or slide down.

$16 Support Emerges as the Crucial Market Anchor

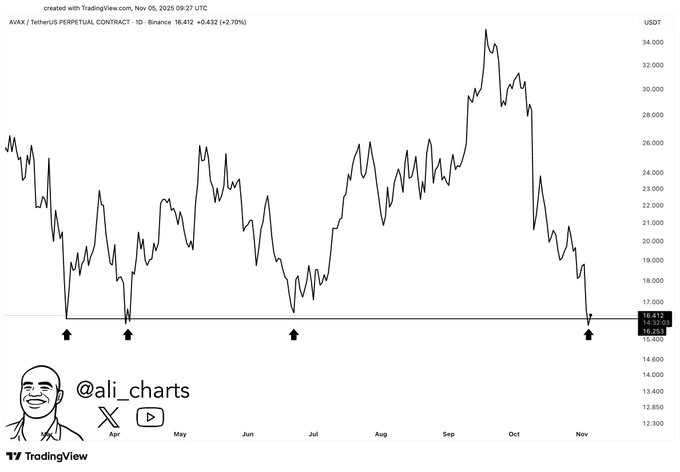

Market analyst Ali shared a chart indicating that the $16 level has acted as Avalanche’s primary support since early 2023. Each prior touch of this level has led to short-term rebounds, confirming its importance as a demand zone. The historical behavior shows repeated buyer interest, making this price area critical to AVAX’s balance between accumulation and potential continuation.

Avalanche has defended this price area multiple times this year, rebounding strongly after previous retests in March, April, and May. Each recovery resulted in notable rallies of 20%–60%, reflecting consistent market participation whenever prices approached the support. The $16 level has therefore evolved into a structural pivot, providing both psychological and technical stability for the asset.

While the historical pattern remains intact, the broader market’s retracement from October highs near $30 has pressured the price toward this level once more. This ongoing test will determine whether Avalanche maintains its established base or experiences a deeper decline into the $15 range.

Trading Volume Sinks as Market Participants Wait for Clarity

As of the writing date, Avalanche had an average price of $16.37, lower by 0.82% over the past 24 hours, as cited by CoinMarketCap. The market capitalization of the project is $6.99 billion making it the 20th most valuable cryptocurrency. Its valuation at full dilution is $11.71 billion, which can be explained by the long-term trust of the market in the utility of this project and the ecosystem.

But the amount of trade has decreased by over 50% to about 444 million and that represents an extremely wary mood of the traders. The market value to volume ratio of 6.33% indicates a less active market stage, with investors apparently undecided, as to when a stronger market signal will help them re-enter it. Its current supply of circulating 426.97 million AVAX of a total of 715.74 million is favorable to moderate inflationary control by comparison to other mid-cap digital assets.

The short term chart shows consolidation in the narrow price range of $16.20 and $17.00. Any prolonged movement beyond $17 can foster the newly started purchasing power in the direction of the $18.20 resistance area. Quite the contrary, a close below 16 can reveal the following demand zone around $15.50.

Ecosystem Growth Utility is Added at the price stagnation.

Outside the technical environment, the ecosystem of Avalanche is also continuing to grow with integrations that increase the accessibility of the projects and the involvement of communities. Recently, it was announced that the Buzz platform by $CGPT has supported Avalanche. Such a collaboration allows creators and developers to build campaigns, encourage engagement, and empower their communities through on-chain engagement tools.

This kind of growth indicates that the network remains committed towards the addition of actual value whilst registering incremental adoption. The integration is considered to be a move in expanding the ecosystem and strengthening its infrastructure of decentralized projects. Such updates can be considered as a counterforce to the existing price stagnation, which emphasizes further progress even in the face of low trading activity.

On balance, the short-term outlook of Avalanche is characterized by the defense of the $16 level. The market seems to be in the waiting period as the level of trading dwindles. Periodic resistance above this price would cause a rebound, whereas a lower retest would cause a retest of the lower areas. The coming days will determine whether Avalanche’s historical resilience at $16 holds firm or gives way to a deeper retracement.