- ROSE/USDT trades near $0.0166, with volume growth showing quiet accumulation around key support levels.

- RSI and MACD both signal improving momentum, pointing toward a potential short-term recovery.

- Price stability above $0.0164 remains crucial for sustaining market confidence and avoiding deeper correction.

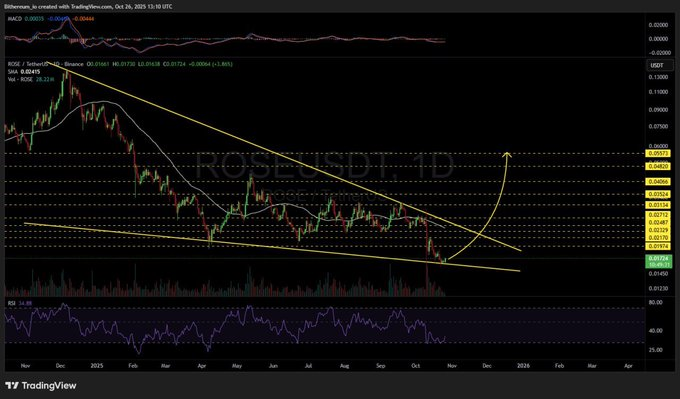

After pulling out of its lower wedge, ROSE/USDT remains in the limelight of the traders. The latest price movements indicate that the market is trying to stabilize with momentum indicators beginning to climb in the upwards direction, which shows that short term recovery efforts are being made.

Falling Wedge Formation Signals Waning Selling Pressure

ROSE/USDT has been trading within a falling wedge pattern for several months, shaping a narrowing structure of lower highs and lower lows. The compression of price action often signals that sellers are losing strength as the market seeks direction.

In a recent update shared by Customized Trader (@Customized_Fix), the analyst pointed out that ROSE has bounced from the wedge’s support line on the daily chart. Both MACD and RSI have also turned positive, indicating that this is usually before a new leg in the positive direction. The post also included short-term levels of $0.01974, $0.02170, and $0.02329, which are near-term resistance levels.

Market action reflects a sustained rebirth of buying interest. The reversal in the $0.018 level triggered new optimism in traders expecting a potential breakout. Should price close above the falling resistance line, momentum could extend to the $0.025–$0.028 zone where earlier supply pressure was contained.

Technical Indicators Reflect Gradual Shift Toward Strength

Momentum indicators now present a supportive tone for ROSE/USDT. The RSI, which had remained below 40 for several weeks, has turned higher, reflecting a slowdown in selling intensity. While the duo established a foundation near current levels, the MACD line also shifted into positive territory, suggesting better sentiment.

The price may be poised to test the mentioned resistance levels if it is to continue trading above $0.018.Traders seeking for early confirmation signals may be drawn to a breakout above $0.0217, which could confirm a trend reversal. On the other hand, if this support is not maintained, attempts at recovery may be delayed.

Volume movement supports this outlook. Increased activity near the lower wedge boundary suggests accumulation among market participants. This pattern typically occurs during transition phases, where longer-term investors position before directional expansion resumes.

ROSE Defends $0.0164 Zone as Traders Monitor Next Reaction

Oasis Network (ROSE) is trading at $0.01662 on CoinMarketCap, losing 5.58% in the past 24 hours. The trading volume rose 8.92% to $4.72 million, indicating that the participation remains strong on the drawdown.

Market capitalization stands at $123.24 million, down slightly from the last correction. The rise in trading volume against falling prices implies active repositioning as traders accumulate at lower levels. Many view the $0.0164–$0.0165 range as a potential short-term base, where previous buying interest emerged earlier this month.

Intraday price action shows that buyers are defending this area with consistency. Provided that bulls are able to remain over $0.0164 and regain over $0.0175, the next target may be created around $0.0180. A slide further down the support, though, can pave the way to $0.0158- $0.0160.