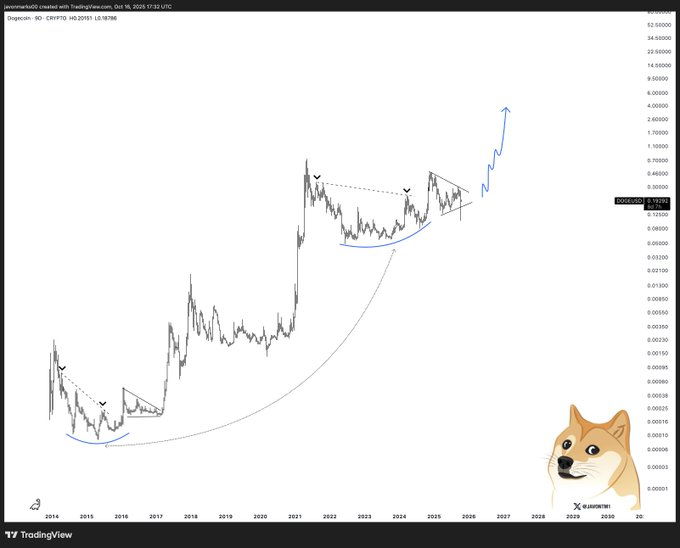

- Dogecoin’s structure mirrors historical pre-rally cycles, suggesting the asset is entering a new phase of long-term accumulation.

- Long/short ratios above 3.0 across major exchanges indicate traders are increasingly positioned for upward price continuation.

- Dogecoin’s key support near $0.19 remains critical as market activity and sentiment stay bullish despite recent volatility.

Dogecoin displays a familiar cyclical formation consistent with its previous pre-rally patterns, while market data and trader positioning suggest that the asset may be preparing for another strong expansion phase toward new all-time highs.

Dogecoin’s Macro Setup Points to Historical Recurrence

The present chart form of Dogecoin is similar to prior long-term cycles that were followed by significant breakouts in 2017 and 2021. The pattern forms through deep accumulation, rising consolidation, and eventual compression before expansion, reflecting historical rhythmic market behavior.

This recurring setup, shared by market analyst Javon Marks, illustrates Dogecoin’s evolving accumulation arc. Each phase in prior cycles began with prolonged base building, followed by a symmetrical tightening pattern before explosive upward continuation. The ongoing rounded base since 2022 reflects this same dynamic.

Previous cycles saw Dogecoin transition from extended lows into sharp parabolic rises once structural resistance levels broke. The current pattern displays a similar trajectory, suggesting that if compression continues to hold above support, the next expansion phase could begin within the same cyclical window.

Market Data Reflects Active Participation Despite Decline

As of the time of writing, Dogecoin trades at $0.1894, reflecting a daily decrease of 3.51%. Trading volume has increased by 24.03% to $3.46 billion, showing heightened market engagement despite near-term bearish pressure.

The asset’s market capitalization stands at $28.68 billion, nearly matching its fully diluted value. This parity is typical for Dogecoin given its uncapped supply.The 12.07% volume to market-cap ratio indicates that there are both retail and institutional investors operating.

Technical readings indicate that Dogecoin experienced intraday selling, yet it was well supported at the area of $0.19.

A tweet from user BIG_M.O noted this level as a strong base, with potential rebound zones near $0.27–$0.33 if buyers maintain momentum at current price floors.

Long/Short Ratios Indicate Strong Bullish Bias

According to statistics of key exchanges, traders are still decisively holding Dogecoin. The DOGE/USDT long-to-short ratio is 3.0193 on Binance, whereas on OKX, it is 3.76, which signifies the strong belief in the further rise in prices.

Top trader activity reinforces this optimism. Binance’s top accounts show a long/short ratio of 3.4248, reflecting accumulation by high-volume participants. The position ratio of 2.1616 indicates measured exposure but still supports a bullish structural bias.

Recent liquidation data shows $8.07K in long liquidations over the past hour and $194.95K in the last four hours. This balance between long and short unwinding reflects temporary volatility but not structural weakness. Together with strong sentiment—85% bullish—the data suggests traders are positioning for a sustained upward phase.