Key Insights

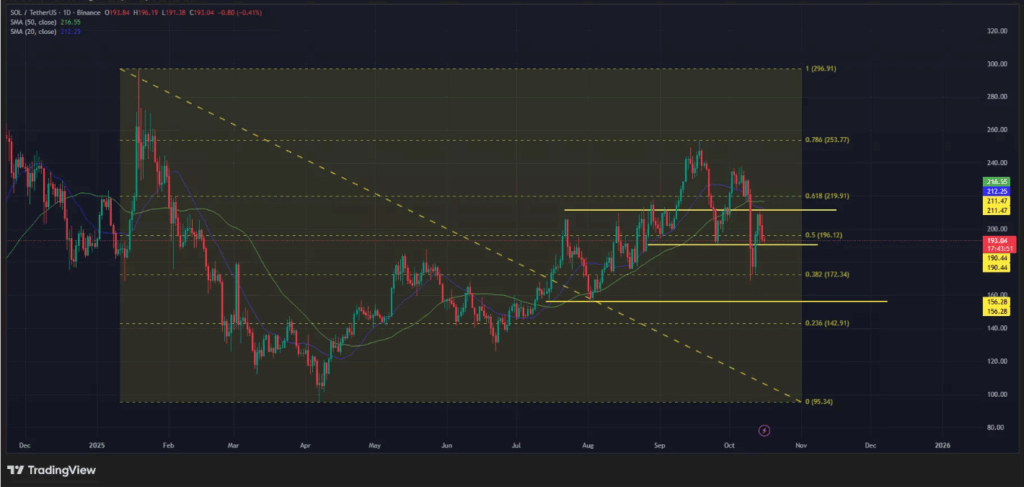

- Solana price dropped 15% in a week, testing the $190 support zone as investors reassess global risk sentiment and macroeconomic trends.

- Technical indicators show potential short-term weakness, with Solana’s 20-day average crossing below its 50-day moving average.

- Strong DeFi activity and growing optimism over a potential spot Solana ETF could help stabilize the token’s outlook in coming weeks.

Solana’s price slipped 15% over the past week and continued to struggle, testing the crucial $190 support zone. The token traded around $193, reflecting a 5.3% daily decline as traders assessed shifting market sentiment and macroeconomic headwinds.

The broader cryptocurrency market turned cautious after renewed U.S. tariffs on Chinese imports rattled global risk appetite. Investors moved to safer assets, leading to a temporary selloff across major tokens. Consequently, Solana’s decline aligned with a wider market downturn that reflected global economic uncertainty.

Sentiment Improves After Fed’s Dovish Remarks

Market sentiment has slightly improved following remarks from the U.S. Federal Reserve chair, who hinted at two possible interest rate cuts later this year. Lower borrowing costs generally support risk assets, including digital currencies. However, traders remain hesitant as they await progress in the upcoming U.S.–China discussions before the November 1 tariff deadline.

Technical signals indicate that Solana may face further downside pressure. The 20-day moving average recently crossed below the 50-day, suggesting a potential bearish setup. If Solana falls below the $190 level, it could retreat toward $170, a key price level seen last week. Conversely, a decisive move above $211 would challenge the current bearish outlook and potentially restore positive momentum.

Network Activity and ETF Optimism Offer Support

Despite price weakness, Solana’s network remains robust. The blockchain recorded over $6.1 billion in decentralized finance trading volume within 24 hours, outperforming competitors such as Ethereum and BNB Chain. This strong performance underscores consistent user engagement even during volatile market conditions.

Investor interest has also intensified following the filing of a Form 8-A by 21Shares with the U.S. Securities and Exchange Commission, marking a step toward the launch of the first Solana spot exchange-traded fund. Approval could attract institutional investors and provide long-term support for Solana’s value as the market steadies in the final quarter of the year.