Key Insights:

- Sui rose 3.6% to $2.82, showing renewed stability after a volatile week marked by range-bound trading.

- Stablecoin market value increased 19% to $1.1 billion, reflecting stronger DeFi trust and growing liquidity.

- Partnership with Figure Technology introduces YLDS, enhancing yield opportunities within Sui’s DeFi ecosystem.

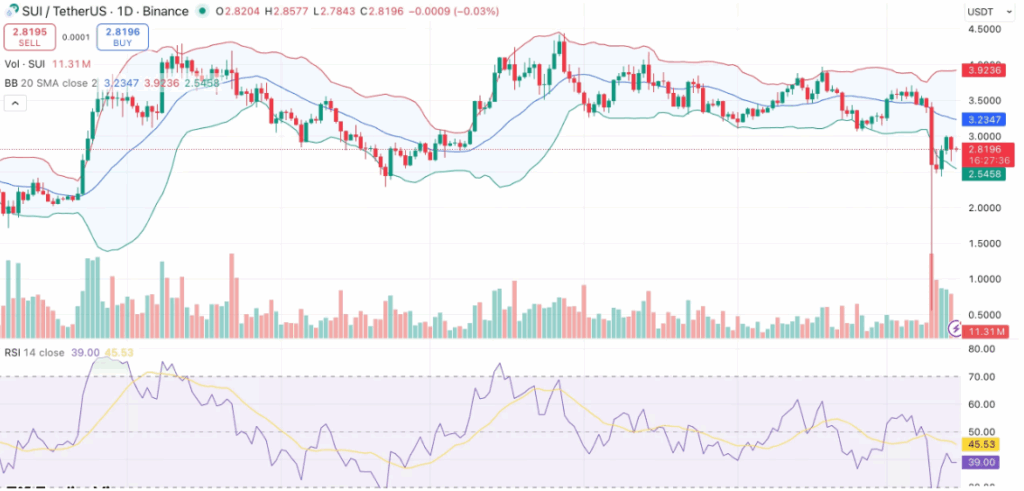

Sui traded at $2.82 at press time, marking a 3.6% increase over the past 24 hours. The token showed signs of stabilization after a volatile week, moving between $2.45 and $3.56. Over the last seven days, Sui gained 3.4% and is up 24% for the month. Despite the rebound, it remains 47% below its January peak of $5.35.

Daily trading volume stood at $1.78 billion, nearly 29% lower than the previous day. Derivatives data from CoinGlass showed that Sui’s futures volume declined 22.9% to $3.92 billion, while open interest increased 5.8% to $875.98 million. This pattern suggests that traders are gradually opening new positions, reflecting anticipation rather than panic.

Stablecoin Expansion Supports Market Strength

Ecosystem liquidity has improved significantly. Data from DeFiLlama indicated that the market value of Sui’s stablecoins increased by 19% in the past week, reaching $1.1 billion. The surge highlights stronger trust in the network’s decentralized finance platforms and an expanding demand for on-chain liquidity.

On October 9, Sui’s total value locked reached an all-time high of $2.63 billion. Decentralized exchange volumes also peaked at $7.92 billion, up from $4.8 billion a week earlier. These milestones signal growing participation from both institutional and retail investors.

New Partnership Brings Yield-Bearing Stablecoin

A major development came on October 14 when Sui partnered with Figure Technology Solutions to launch YLDS, a yield-bearing stablecoin backed by U.S. Treasuries. The integration enables users to convert USDC into yield-generating assets via DeepBook, Sui’s decentralized trading platform.

Sui’s roadmap includes two upcoming native stablecoins, suiUSDe and USDi, expected by late 2025 in collaboration with Ethena Labs and the Sui Foundation. Technically, Sui’s relative strength index hovered near 39, approaching oversold territory. The 10-day EMA at $3.00 and the 20-day EMA at $3.16 mark key resistance levels for recovery.

If Sui maintains support above $2.60, it may retest the $3.10–$3.20 range. A move beyond $3.35 could strengthen momentum toward $3.80.