- A drop below the trendline is a sign of capital rotation to altcoins.

- $5.95B inflows were recorded in a week, driven by the U.S. ETFs and broad investor demand.

- BTC and ETH rallied over 10%, while Solana and XRP also saw notable inflows and ecosystem growth.

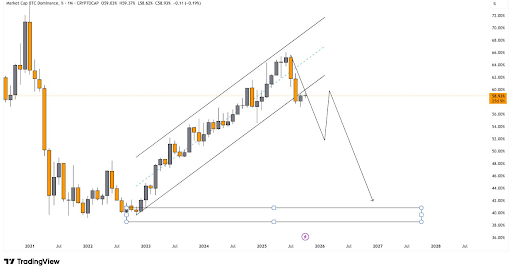

Bitcoin dominance has broken its monthly uptrend, after traders shift toward altcoins, and crypto capital investment hit record high inflows, supporting strong rallies in ETH, and other tokens.

Breakdown Signals Shift to Altcoins

BTC.D has slipped below a support line from 60-62% by mid-2025 on the monthly chart. This drop hints that Bitcoin’s hold on the market might be weakening, and money could start moving into altcoins.

Source Rose Premium Signals

After this fall, there might be a small bounce back to test the old support line—something traders often see before a bigger drop. If this downward trend continues, Bitcoin dominance could drop to the 40–42% range, a level we last saw in mid-2022. This usually signals a strong altseason, where altcoins gain more ground against Bitcoin.

Bitcoin Price Action and Levels to Watch

Bitcoin’s price has recently pushed past several key resistance levels and is now trading close to $123,686 facing a tough resistance zone between $123,726 and $124,475.

If Bitcoin breaks and holds above this area, it could move up toward $127,447 and even $130,068,but if it fails it could pull back to support levels between $120,998 and $117,900. A deeper drop might take it down to the $108,000 buying zone, where buyers showed up before. Keeping an eye on volume and price action here is crucial.

Record Crypto Inflows and Altcoin Ecosystem Growth

Last week, global crypto investment products saw a record-breaking $5.95 billion in inflows, the highest ever recorded. The majority of this money came from U.S. ETFs, with BlackRock’s Bitcoin (IBIT) and Ethereum (ETHA) funds bringing in nearly $5 billion. This surge followed recent U.S. interest rate cuts, weak employment numbers, and worries about a government shutdown, all of which helped boost demand for cryptocurrencies.

Ethereum led with a massive $3.55 billion in inflows, while Solana also set a new weekly record, pulling in $706.5 million. Solana’s network remains active, boasting over a million daily users and nearly $6 billion locked in DeFi projects; XRP funds also attracted $219.4 million last week .

Rising altcoin strength and a drop in Bitcoin dominance, suggest growing interest in altcoins. The market may be preparing for a strong altseason soon.