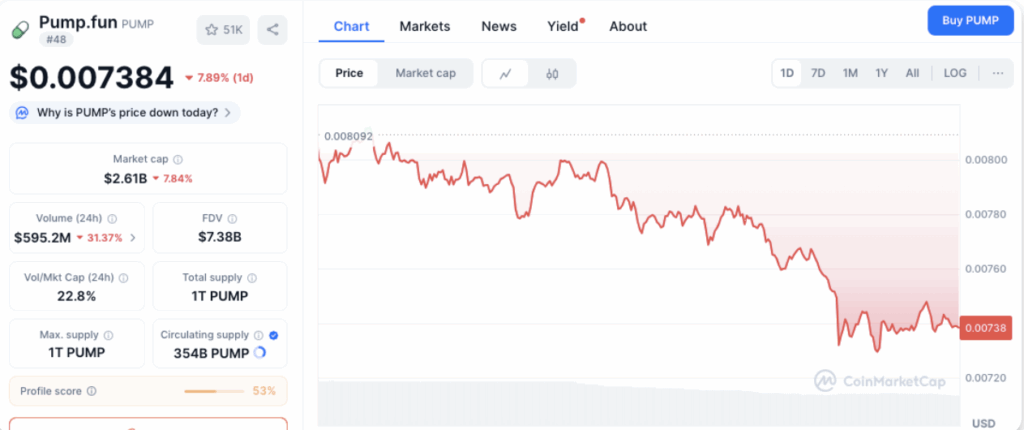

- PUMP token faces critical support at $0.00740 while resistance holds at $0.008. Traders await a clear direction.

- Open interest in PUMP futures stands at $1.1 billion, reflecting strong market engagement despite slight declines.

- Polarized market sentiment in Hyperliquid mirrors PUMP’s current setup, signaling a volatile trading environment ahead.

The PUMP token is currently testing a critical support level at $0.00740 after slipping 7.71% over the past 24 hours. Despite this decline, the token’s trading volume has surged by 28.36%, reaching $623 million. This indicates that market participants remain highly engaged, although uncertainty about the next move lingers. The token reached a recent high of $0.008092 but quickly retraced, with $0.008 continuing to serve as a significant resistance level.

Technical indicators reveal mixed signals for PUMP. The Relative Strength Index (RSI) is near 74, indicating overbought conditions that typically precede either a pullback or a consolidation phase. Meanwhile, the MACD shows a bullish momentum but is flattening, suggesting that the upward drive might be losing steam. These mixed signals suggest that traders may choose to wait for clearer confirmation before betting on a continuation of the rally.

Open Interest Remains High, Market Engagement Strong

Open interest in PUMP futures is substantial, standing at $1.1 billion. This high level of engagement reflects the continued interest from traders, although there has been a slight daily decline of 1.16%. The concentration of open interest on major platforms such as Hyperliquid, Binance, and Bybit further emphasizes the speculative positioning within the market. The rising number of perpetual contracts suggests traders are positioning for short-term price movements, indicating a high level of market tension.

Similar to PUMP, the market sentiment surrounding Hyperliquid remains sharply divided. Smart money holds a significant long position of $86 million, while public traders are more balanced with $47 million long against $22 million short. Whale wallets also show a relatively balanced stance, with $259 million long and $248 million short. This polarized positioning creates a volatile environment where price shifts could occur swiftly, particularly if liquidations or changes in sentiment occur.

The current market scenario suggests that traders are anticipating significant price action in the near future, but the outcome remains uncertain. A breakdown below the $0.00740 support level could open the door for further downside, while a breakout above $0.008 might trigger a fresh round of buying pressure. As both PUMP and Hyperliquid experience similar dynamics, all eyes will remain on these key levels for potential clues about the direction of the market.