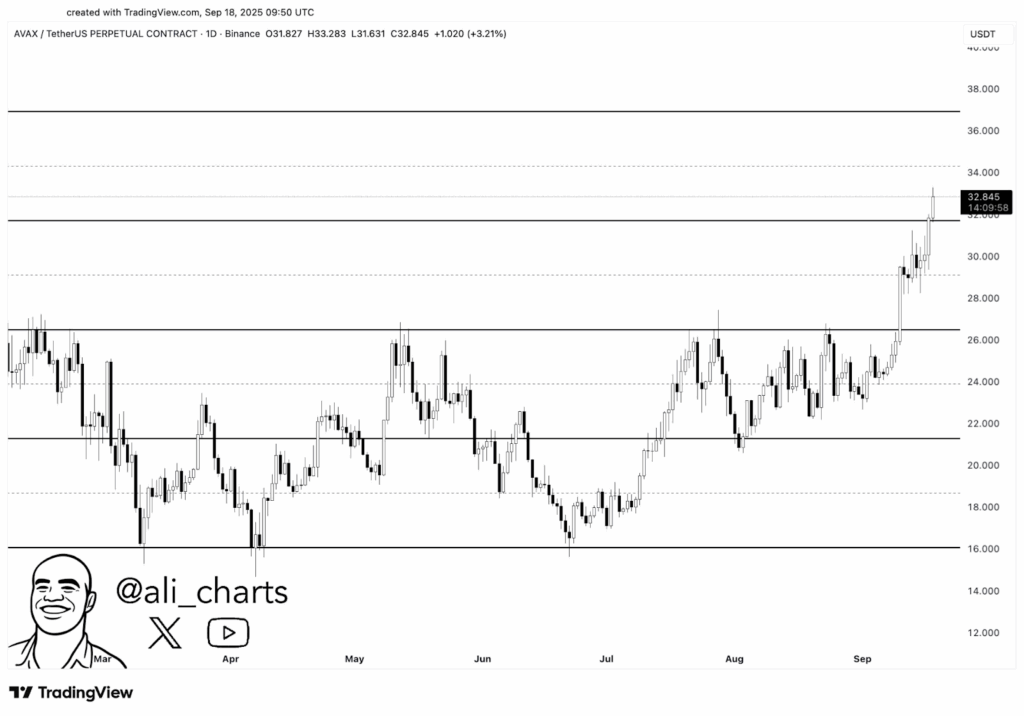

- Avalanche breaks above $32 resistance, turning it into support and strengthening bullish structure with buyers controlling momentum.

- Analyst Ali projects $37 as the next target after AVAX cleared $30 and $32 zones, reinforcing its upward market trajectory.

- Trading volume rises 26% to $2.12B, with $34.23 price showing continued investor confidence and strong market activity.

Avalanche ($AVAX) has extended its upward movement, building on recent gains after clearing key resistance levels. Analysts now view $37 as the next target, supported by growing trading activity and continued investor confidence in the asset’s momentum.

Avalanche Breaks Key Resistance Levels

Avalanche ($AVAX) has shown renewed strength after breaking above multiple resistance zones, with the price reaching $34.23 and a market cap of $14.39 billion. Daily trading volume has surged to $2.12 billion, representing a 26% increase in market activity.

According to analyst Ali (@ali_charts), $AVAX’s breakout above the $30 and $32 levels has shifted the market structure in favor of buyers. He noted that Avalanche “keeps pushing forward,” with $37 now emerging as the next resistance to monitor.

The move above $30, which had capped rallies earlier this year, proved critical. A daily close beyond this threshold confirmed a strong continuation of the uptrend and reinforced market confidence.

Analysts Target $37 as Next Barrier

Ali emphasized that surpassing $32 has positioned Avalanche for further gains, with $37 being the next technical level derived from past supply zones. This target aligns with a measured move from the recent breakout structure.

Market analyst Cryptonomian also highlighted Avalanche’s impressive day, noting an intraday rise of more than 11.7% during the rally. Such performance reflects the growing momentum supported by buyers.

Technical indicators suggest Avalanche has maintained higher highs and higher lows since September. The $33–$34 range is now being closely watched as a potential launchpad for further upside.

Market Structure and Trading Outlook

Avalanche has developed a clear ascending trend, with each pullback attracting strong buying interest since late July. The consolidation between $26 and $30 created the base for the current upward push.

The breakout above $30 and $32 has shifted these areas into support. Sustaining these levels is essential for buyers to maintain control and press toward $37. If cleared, this resistance could open the way toward $40 in the medium term.

The latest data confirms Avalanche’s momentum. The price as of the time of writing, is $34.23, with trading volume at $2.12 billion. Market participation remains high, reinforcing analysts’ views of continued strength.