- Stellar (XLM) has been maintained at almost $0.30 support, which may see it recover and resume to at least 0.37 inside a given downward channel.

- XLM market cap stands at $10.46B with stable liquidity despite a 20.77% decline in daily trading volume.

- The tactical accumulation phase is supported by the outlook of analysts as the sentiment is expected to improve in the wider digital asset markets.

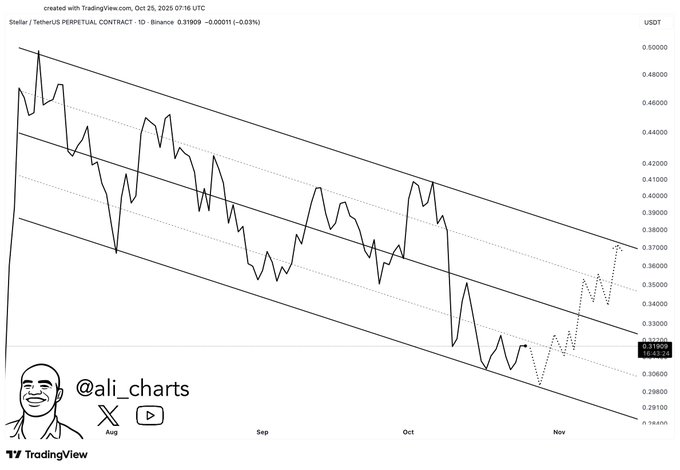

Stellar (XLM) remains positioned within a descending channel structure, where traders anticipate a rebound phase as buying interest consolidates near key support levels. Technical conditions suggest potential recovery momentum building toward upper resistance zones.

Strategic Buy Zone at $0.30

Analyst Ali (@ali_charts) has drawn attention to Stellar’s descending channel formation, suggesting a potential bullish reversal setup within its ongoing corrective pattern. His analysis emphasizes a strategic entry near the $0.30 level, aligning with the lower boundary of the channel where previous reactions have sparked temporary recoveries. The structure displays an organized pattern of lower highs and lower lows, maintaining technical discipline while allowing for controlled rebounds.

The identified support near $0.30 has historically triggered renewed accumulation. Each interaction with this level has generated mean-reversion rallies toward the channel midpoint. Current conditions mirror past rebounds, making the zone a tactical accumulation area for medium-term traders. A successful defense of this level could lift XLM toward the $0.34–$0.35 range, with a possible extension to $0.37 if momentum persists.

Ali’s observation—“At $0.30, we buy the dip before Stellar $XLM rallies to $0.37”—summarizes this structured approach. The strategy reflects disciplined positioning rather than speculative entry, focusing on capturing the measured rebound within a larger downtrend. This framework indicates calculated risk exposure with clearly defined exit levels.

Market Structure and Technical Rhythm

Stellar’s chart behavior maintains a steady rhythm across the descending channel, displaying consistent reactions between its boundaries. The midline serves as a key equilibrium point, where price consolidation often precedes directional continuation. A daily close above this central band would reinforce the developing bullish setup and open room toward the $0.37 upper resistance.

The channel’s structure also reveals compressing volatility—an early sign that selling momentum may be weakening. Historical symmetry between past rebounds supports the probability of another proportional upswing, provided that market participants sustain buying pressure at current levels. Such alignment strengthens the case for a controlled rebound phase rather than erratic short-term volatility.

Momentum dynamics support this evolving narrative. Although oscillators are not shown, moderating downward slopes often precede positive divergences on daily frames. These patterns suggest fading bearish energy, setting the groundwork for a shift from distribution toward accumulation within the channel’s lower zone.

Current Market Data and Sentiment Shift

The latest CoinMarketCap statistics show Stellar (XLM) trading at $0.3267, +2.04% in the past 24 hours. The token’s market capitalization is $10.46 billion with a circulating supply of 32.02 billion XLM. Coupled with a decline of 20.77% in the token’s daily volume, liquidity remains high, confirmed by a Volume-to-Market Cap figure of 1.57%—an indication of steady market activity.

The intraday chart displays constructive accumulation patterns since XLM trading between $0.3195 and $0.3300 signifies measured recovery advances. This steady movement mirrors Ali’s technical framework, where XLM’s rebound trajectory aligns with the expected path toward midline resistance.

Social sentiment also reflects cautious optimism. A trader under the alias Z988-Crypto noted that “$XLM is setting up beautifully on BingX,” referencing its tendency to precede XRP in market movements. Combined with the channel-based analysis, these developments reinforce an improving outlook for Stellar as it attempts a climb toward $0.35–$0.37 in the near term.