Key Insights

- Solana’s price has fallen over 35% since September, signaling a bear market despite increasing investor demand through ETFs.

- U.S.-based Solana funds have reached $575 million in assets as institutional inflows continue following Grayscale’s fee waiver.

- Technical indicators, including an impending death cross and bearish formations, point toward a possible 20% additional decline.

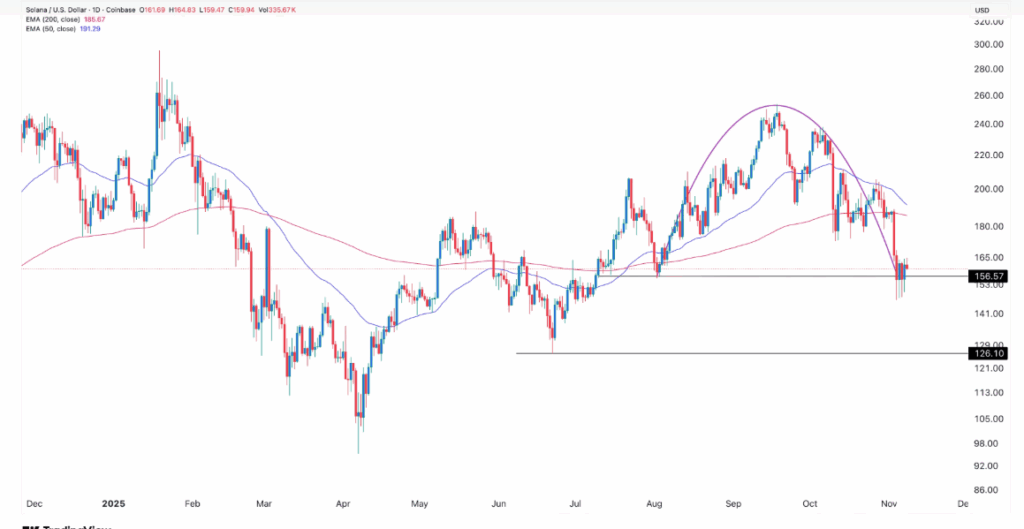

Solana’s price has entered a bear market after sliding more than 35% from its September high. The token is currently trading near $160, marking its weakest level since August. Despite substantial inflows into Solana-linked exchange-traded funds, its value remains under pressure due to broader market weakness.

Recent data from SoSoValue revealed that U.S.-based Solana funds recorded $12.6 million in inflows on Friday, lifting the cumulative total to $337 million. Bitwise’s BSOL holds $478 million in assets, while Grayscale’s GSOL stands at $97 million. Collectively, these funds now represent 0.64% of Solana’s total market capitalization. The rising demand follows Grayscale’s decision to waive management fees, a move that has likely supported renewed institutional participation.

Broader Market Weakness Adds Pressure on Solana

The continued decline in Solana’s price coincides with weakness across the crypto market as investors weigh potential policy moves by the Federal Reserve. Bitcoin and other altcoins have struggled to regain momentum in recent weeks. Moreover, Solana’s ecosystem has not benefited from the surge in market segments such as artificial intelligence or privacy tokens, where projects like Near, Filecoin, and Monero have led recent gains.

From a technical perspective, Solana appears poised for further losses. Analysts note that the cryptocurrency is nearing the formation of a death cross pattern on its daily chart, which occurs when the 50-day moving average crosses below the 200-day moving average. This pattern often signals extended bearish sentiment. In addition, the chart reveals an inverse cup-and-handle structure and a bearish pennant formation, both of which indicate potential declines.

Support Levels and Outlook Ahead

Traders are now watching the key support zone around $126, the lowest level reached in June. A drop to this range would represent another 20% decline from current levels. However, despite the current market stress, Solana’s long-term outlook remains supported by solid fundamentals, including its upcoming Alpenglow upgrade, which aims to boost transaction speeds, reduce validator costs, and enhance network efficiency.