- Analyst Jameson projects PEPE could reach a $20B+ valuation once Bitcoin dominance rolls over.

- PEPE trades near $0.000009816, showing strong liquidity and firm support despite a 2.3% daily dip.

- Ethereum’s 10.6% weekly gain signals an upcoming rotation that could benefit PEPE and other altcoins.

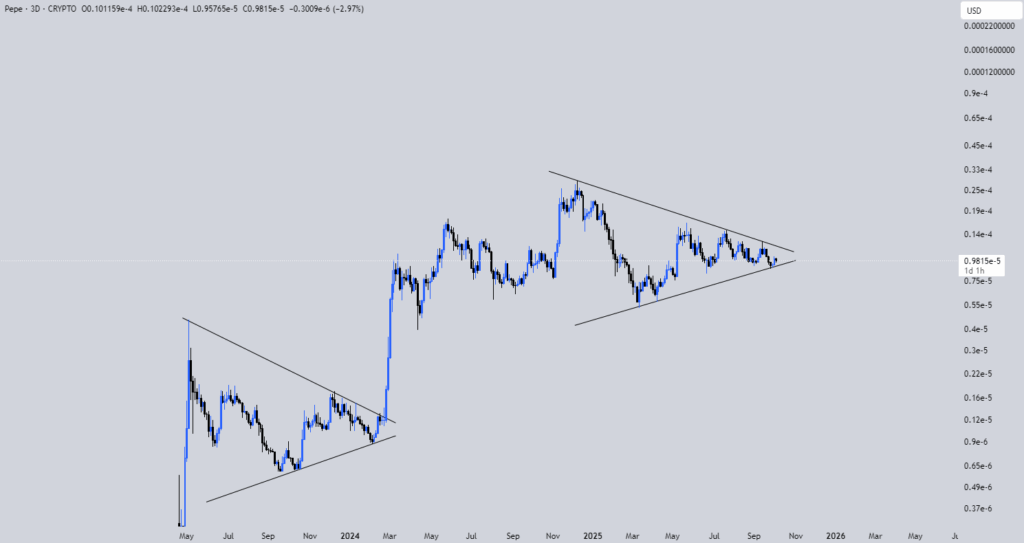

PEPE’s current consolidation phase shows tightening market activity and reduced volatility, while technical indicators suggest a potential major breakout. The coin’s structure mirrors earlier pre-rally conditions as market attention shifts toward Ethereum’s growing strength.

Technical Formation and Analyst Outlook

Crypto market analyst Jameson (@jamesonxbt) recently shared a detailed outlook on PEPE, emphasizing a long-term symmetrical triangle formation. The structure mirrors a previous setup that preceded PEPE’s strong breakout in late 2023. According to the analyst, there is “no second best meme coin,” and a $20B+ market capitalization for PEPE appears inevitable once Bitcoin dominance declines and ETH/BTC rallies.

The chart pattern reflects a phase of volatility compression where price action forms lower highs and higher lows. This behavior typically suggests a buildup of momentum before expansion. The support and resistance lines have been respected consistently since early 2024, revealing technical discipline in price movements.

Jameson’s perspective links macro market rotation with PEPE’s technical setup. Historically, when Bitcoin dominance (BTC.D) falls, liquidity shifts toward Ethereum and altcoins, often fueling explosive rallies in meme assets. The analyst anticipates PEPE could print “40%+ daily candles and 200%+ weekly moves” once this phase begins.

Market Data and Current Position

According to CoinGecko, PEPE trades at $0.000009816, down 2.3% in the last 24 hours. The coin maintains a market capitalization of approximately $4.13 billion with an identical fully diluted valuation, indicating its total supply of 420.69 trillion tokens is already in circulation. This parity shows the absence of future dilution, with price purely driven by liquidity and investor demand.

PEPE has registered a trading volume of $504 million in the last 24 hours, which is a sign of active involvement and constant liquidity. Although the key dropped briefly in the short term, the token has been trading between the $0.0000098 support level and the level has been very appealing to buyers. This stability suggests sustained accumulation among market participants.

The short-term volatility reveals hasty selloffs and recoveries, which is indicative of the range-bound trading. The present stage is considered to be a consolidation zone not a reversal. The traders are still tracking the $0.0000098-0.0000100 as a key directional level.

Broader Crypto Context and Market Correlation

The broader crypto landscape reflects parallel resilience. Bitcoin (BTC) is, as of writing, trading at $123,426 and it has decreased by 1.06% per day but has gained 10.54% per week. Close behind is Ethereum (ETH) with a price of $4,535.39, falling by 1.10 percent in a day but improving by 10.67 percent in the week. Such movements support a risk-on environment, which most altcoins and meme tokens prefer.

If the ETH/BTC pair strengthens further, capital rotation could extend into speculative assets like PEPE. Historical patterns show that meme coins outperform during these phases due to amplified liquidity flow. This macro setup aligns with Jameson’s projection that patience may soon yield substantial returns.

PEPE’s current trajectory, backed by technical compression and strong market liquidity, positions it for potential upward continuation. With volatility poised to expand and macro indicators turning supportive, the asset remains closely watched as one of the most active meme tokens in the market.