- NEAR shows long-term compression and a rounded bottom after extended declines in both USD and BTC valuations.

- Bullish divergence forms on the NEAR/BTC chart as momentum trends higher while price prints lower lows.

- Growing NEAR Intents revenue strengthens the view that current market value trails fundamental expansion.

NEAR begins the period with shifting technical conditions marked by compression, declining sell pressure, and volatile monthly performance. Traders continue watching its behavior as the market adjusts to changing liquidity across USD and BTC pairs.

Market Compression and Technical Positioning

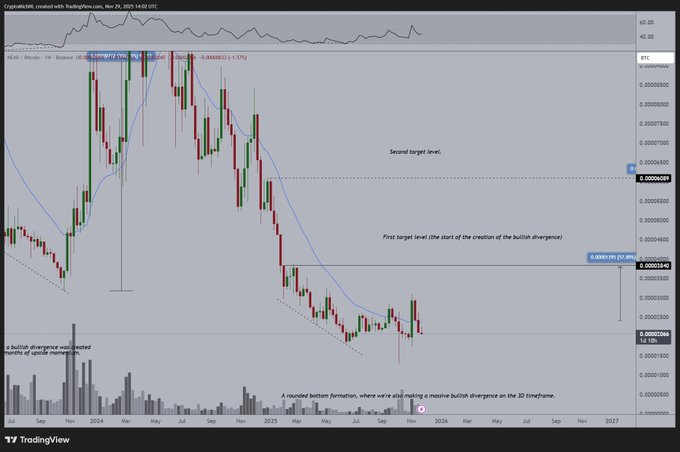

The broader NEAR chart shows prolonged compression that formed after months of heavy declines. This phase developed into a rounded bottom structure, commonly associated with quieter accumulation during weaker market participation. The pattern suggests firming stability rather than impulsive selling.

In a recent market update, Michaël van de Poppe described NEAR as positioned within a deep-value region following an extended period of capitulation-level pricing. His remarks centered on the mispricing seen between the token’s current valuation and the rapid expansion driven by NEAR Intents.

NEAR as of writing, trades near $1.84, moving well below the peak recorded earlier in the month. Lower highs and lower lows emerged as the asset retraced, while dashboard metrics show a 26% decline in 24-hour volume and a modest reduction in market cap, signaling cooling short-term activity.

Bullish Divergence and Rounded Bottom Formation

The NEAR/BTC pair presents a notable long-term bullish divergence. Price action produced lower lows across the structure, yet momentum continued climbing. This type of divergence often forms after seller exhaustion and slow rebuilding of bid strength.

Repeated tests of the lower boundary brought tighter candles and reduced sell pressure. These developments align with accumulation behavior seen during transitional phases. Poppe referenced these dynamics when addressing the emerging structural shift in NEAR.

Two nearby targets come into view on the BTC pair. The first sits around 0.00002 BTC, marking the region where divergence began. The next level near 0.000035 BTC represents former support and a potential continuation zone should broader momentum improve.

Fundamental Expansion and Accumulation Narrative

NEAR Intents continues to accelerate in revenue and activity, creating a visible gap between the token’s price and its fundamental trajectory. This widening difference supports ongoing discussion around mispricing across both USD and BTC valuations.

Although market cap declined to about $2.36B and trading volume eased, the underlying adoption trend remains firm. These conditions often appear in early stages of structural consolidation before broader participation returns. Market behavior shows the shift from impulsive decline toward stabilization.

Bitcoin maintained a narrower downward range during the same period, reflecting its larger market footprint. NEAR showed stronger sensitivity to sentiment, producing swift rallies and equally fast retracements. Even so, compression, divergence, and expanding fundamentals continue shaping its developing market structure.