- Hoffman says Ethereum’s culture is blocking growth by rejecting key app players.

- ETH’s chart shows strong recovery but mixed signals in short-term momentum.

- Glisic backs Ethereum’s role as core finance infrastructure despite rising rivals.

Ethereum’s price recovery has sparked renewed debate about its future, with leaders urging major cultural and technical changes. The altcoin recently bounced back from a multi-month low, but structural tensions remain across its ecosystem.

Hoffman Blames Ethereum Leadership for Alienation

David Hoffman, in his post on X, stated that Ethereum’s leadership “has alienated users and builders by being hostile to its own app layer.” He criticized the public exorcism of Lido Finance and rejection of traders and degens across Ethereum’s ecosystem. Hoffman added, “If we want ETH to grow, we need to attract users and builders—not push them away.”

He claimed that the Ethereum Foundation and its community have tried to enforce what counts as “approved” behavior on a permissionless chain. According to Hoffman, this approach damages growth and discourages innovation by rejecting commercial use cases. He urged a cultural reset focused on Layer 1 scaling and developer inclusion.

Ethereum Technical Indicators Show Mixed Signals

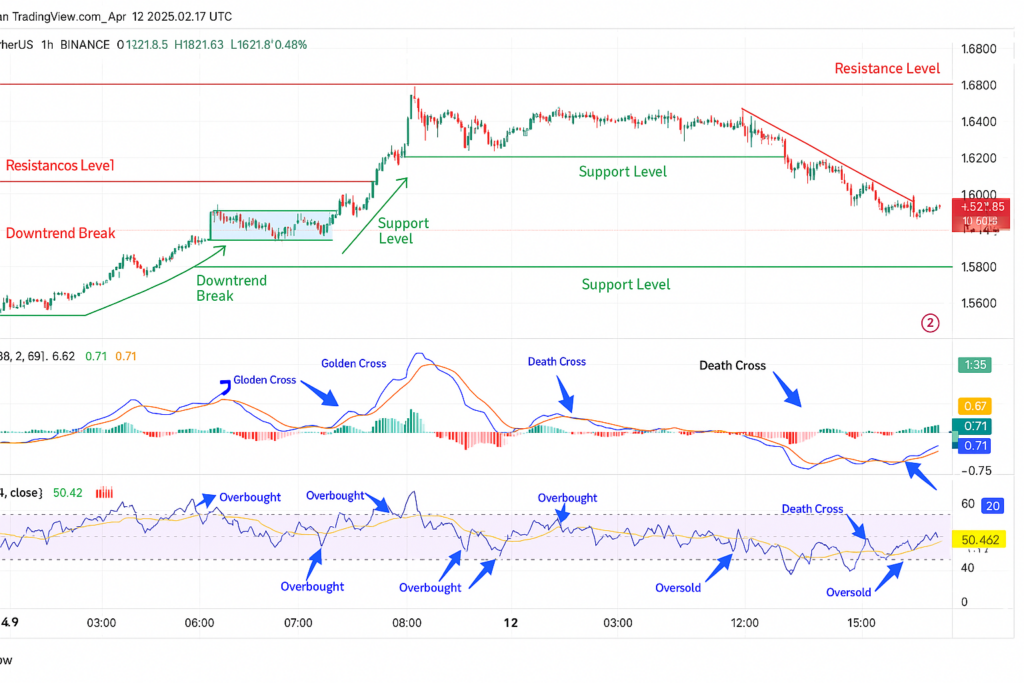

In tracking the price behavior of Ethereum in TradingView, the ETH/USDT five-minute chart displayed a sequence of key movements backed by RSI and MACD technical indicators. The structure showed an early downtrend that reversed at $1,560 support before rallying past $1,600 and peaking above $1,670. After testing resistance at $1,665 multiple times, Ethereum consolidated near $1,615 before slipping into a new downward leg.

MACD golden crosses emerged during bullish rallies, while death crosses marked phases of declining momentum in later periods. RSI first flashed oversold at $1,545, then rose above 70 as prices climbed. The asset later returned to neutral before flashing another oversold signal during the pullback to $1,600.

Ethereum’s Investment Thesis Remains on Infrastructure

Leo Glisic, in a recent statement, reiterated Ethereum’s position as the “settlement and interoperability layer” for global finance. He stated that Ethereum is already winning in infrastructure adoption, citing the growing dominance of stablecoins and Layer 2 solutions. Glisic emphasized that Ethereum’s fee model must remain low to enable mass onboarding.

The long-term strategy focuses on driving scale first, then monetizing through gas fees as adoption matures. According to multiple public reports, Ethereum continues to dominate institutional blockchain exposure while Solana emerges as a challenger. However, investors still prefer Ethereum’s regulatory posture, custody support, and infrastructure scale.