- BNB’s all-time high surge is supported by strategic alliances, including a partnership with Franklin Templeton.

- Technical patterns suggest BNB’s price could reach up to $1,500 in the coming weeks.

- Institutional backing, including CEA Industries’ $368 million purchase, strengthens BNB’s growth prospects.

Binance Coin (BNB) has recently surged to an all-time high above $904, following significant institutional support. This rally comes after Binance formed a strategic alliance with Franklin Templeton, a renowned asset management firm managing $1.6 trillion in assets. This collaboration has injected institutional confidence into the Binance ecosystem, supporting the coin’s growth trajectory.

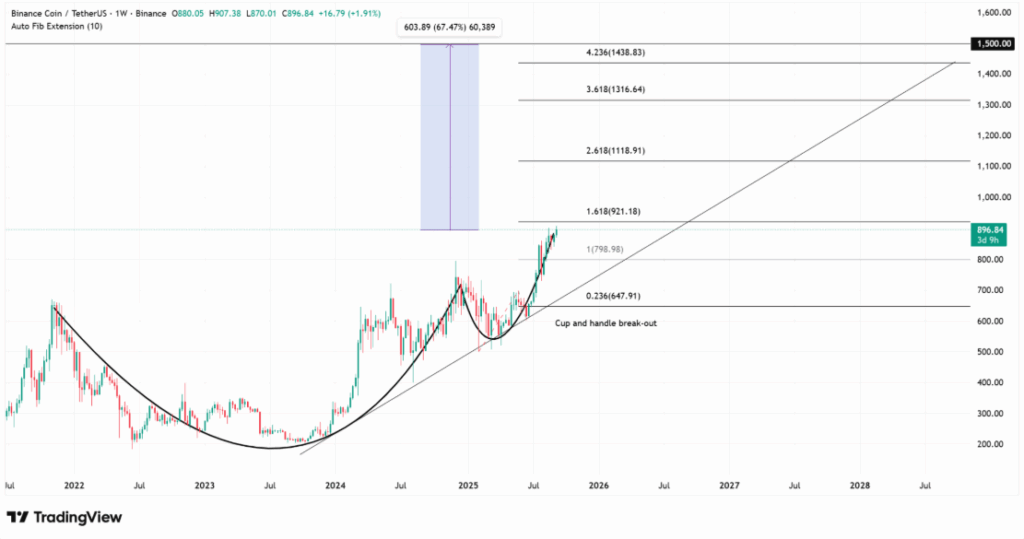

BNB’s price chart is currently reflecting a strong bullish pattern, following a breakout from a cup-and-handle structure. The coin is now consolidating around $896, with the next immediate resistance at $921. A sustained breakthrough above this level could propel the price to $1,118, $1,316, and eventually towards $1,438.

Market analysis even suggests that the $1,500 mark is within reach, further affirming the optimistic outlook. However, failure to maintain the $798 support zone could result in a price pullback toward $647, where demand may pick up again.

Institutional Support Strengthens Long-Term Outlook

The partnership with Franklin Templeton strengthens BNB’s role as a blockchain-based asset, particularly in regulated markets. This alliance signals a wider acceptance of blockchain technology within traditional finance. Additionally, CEA Industries’ $368 million investment in BNB further tightens the available supply, boosting its potential for growth. This institutional backing creates a foundation that suggests continued bullish momentum, reducing the chances of sudden market volatility.

Binance Coin’s price remains well-supported by rising demand and strong technical patterns. The coin has continued to print higher lows, indicating consistent market strength. Furthermore, its collaboration with Franklin Templeton highlights Binance’s shift toward deeper integration with traditional financial frameworks. This strategic move could drive long-term stability and growth for BNB, especially as institutional involvement expands. As the market continues to respond favorably, the outlook for BNB remains positive.