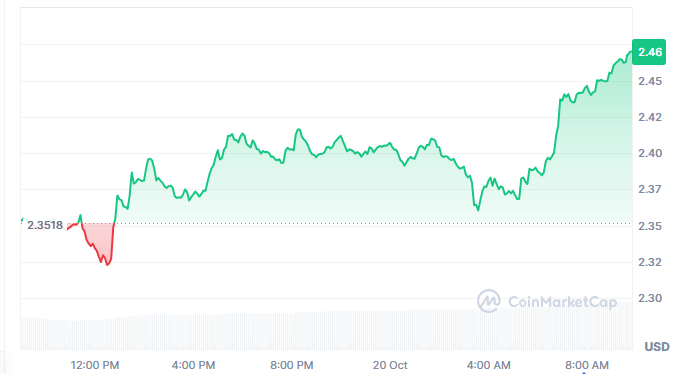

- XRP remains stable near $2.46, showing a recovery pattern backed by rising volume and improved market confidence.

- Long positions dominate across exchanges as traders await confirmation of a potential bullish breakout structure.

- Bitcoin dominance remains the pivotal factor that could determine XRP’s next directional move.

XRP enters a phase of technical equilibrium, trading in a calm but strategic zone as traders monitor Bitcoin Dominance for market direction, with growing anticipation of a potential breakout from its consolidation range.

A Market Balancing Between Calm and Momentum

XRP’s current structure suggests a market caught between stability and anticipation. Price movement across daily and intraday charts reveals a cautious environment where buyers and sellers await a decisive signal. Trading activity indicates resilience, yet conviction remains measured as the broader market stays sensitive to Bitcoin’s dominance trends.

The asset’s market capitalization is valued at approximately $147.92 billion, reflecting a modest daily gain of 5.11%. At $4.04 billion, trading volume rose by more than 53%, indicating a resurgence of market activity. Analysts interpret this as early accumulation behavior around the $2.34 demand zone, where a rebound structure is now forming.

The recent attempt towards $2.46 has seen better sentiment, however XRP remains capped under a falling resistance line from August highs. The flat base pivot points at $2.75, $3.15 and $3.65 could be breakout early entry; a surge in volume if the stock settles above this point would help to establish the medium-term uptrend is confirmed.

Traders Track Bitcoin Dominance and XRPBTC Setup

In a recent technical update, CRYPTOWZRD noted that XRP’s daily close appeared indecisive but maintained potential for a strong upside move through the XRPBTC pair. Moreover, the trader emphasized that if Bitcoin Dominance starts to decrease, liquidity may flow into altcoins and this could be bullish for XRP in its current range. This view is also in sync with the present sentiment indicators, seeing as that on Binance, the long-to-short ratio is approximately 2.83 — illustrating a bias among traders that could be read bearishly. Furthermore, the XRPUSDT top trader ratios are slightly lower at around 2.94 but are still

encouraging. The consistent preference for long positions indicates that many are expecting a continued price recovery, though we can’t ignore the chance of some short-term corrections.

If Bitcoin manages to keep its grip on the market, XRP might find itself consolidating between $2.34 and $2.75, creating a larger accumulation base. On the flip side, if Bitcoin Dominance starts to slip, we could see a capital rotation that pushes prices toward the $3.15–$3.65 resistance zone. Traders are keeping a close eye on lower-timeframe confirmation patterns, like higher lows or engulfing candles, to guide their next moves.

Volume Expansion and Technical Stability Define the Outlook

XRP’s rebound from the $2.34 zone forms a V-shaped recovery pattern supported by expanding volume, a structure suggesting buyer strength at lower levels. The $2.52 billion intraday volume represents a critical turning point, and both the daily and 15-minute charts show a steady increase in trading participation.

Major exchanges’ liquidity data, which reveals short-liquidation events totaling roughly $1.40 million in four hours, supports the trend. This pattern indicates that sellers were forced out as buyers regained dominance, amplifying the recent upward momentum.

From a structural standpoint, XRP’s psychological floor remains anchored around $2.00, serving as both a demand zone and accumulation base. As long as this support holds, traders may treat pullbacks toward $2.75 or $3.15 as staging levels for a potential breakout. If market sentiment sustains and Bitcoin Dominance eases, XRP could aim to reclaim higher valuation levels.