- Strategy $MSTR must defend $257 support, a breakdown may open the way toward $120.

- MSTR2100 trades at $0.1234 with nearly full token circulation and stable liquidity.

- Micro-cap status of MSTR2100 creates both growth opportunities and high volatility risks.

Strategy $MSTR faces critical chart levels while MSTR2100 shows steady market action. With fractal echoes repeating and circulating supply nearly complete, traders are focusing on support and liquidity levels that could define the next phase of performance.

Fractal Setup in Strategy $MSTR

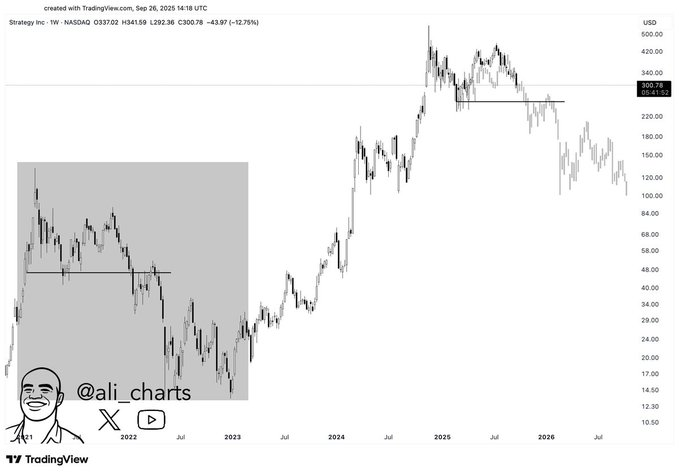

Ali (@ali_charts) noted that Strategy $MSTR is repeating its 2021–2023 fractal, with $257 standing as the pivotal support. During the earlier cycle, the price collapsed after losing a similar base.

In 2025, the stock peaked above $450 before rolling lower. Price action now rests above $257, making this the key decision zone for bulls and bears. A rebound above $300–$340 would neutralize bearish pressure.

A breakdown would confirm the fractal pattern and expose the path to $180 and eventually $120. Investor psychology often repeats in such setups, showing the risk of accelerated declines when crucial support levels fail.

Risk and Reward Dynamics for Traders

The $257 support level remains the market’s focal point. Bulls aim to defend it and create stability, while bears are watching for weakness. If maintained, sideways consolidation or even a bounce remains possible.

Should $257 fail decisively, bearish continuation becomes more likely. The fractal structure implies that lower targets of $180 and $120 may come into play, repeating the correction from the earlier cycle.

This sets up an asymmetric picture for traders. The upside near-term is limited unless it is proved that it has recovered at $340, and the downside is wide provided that it is proved that it has broken at $257. Under such circumstances, risk management is essential.

Market Action in MSTR2100 Token

MSTR2100 is as of writing, trading at $0.1234, up 5.4% in 24 hours. Daily trading volume stands at $213.16K, down 8.31% from the prior session. The price has shown steady intraday action from $0.1174 to its current level.

The token’s market cap is $2.54 million, classifying it as a micro-cap. Fully diluted valuation is $2.59 million, showing limited dilution risk as 20.64M tokens circulate out of a total 21M supply.

MSTR2100 has 7.22K holders with a profile score of 48%. Liquidity looks fair, with a volume-to-market cap ratio of nearly 9%. While growth opportunities exist, the small community base and modest rating also highlight volatility risk.