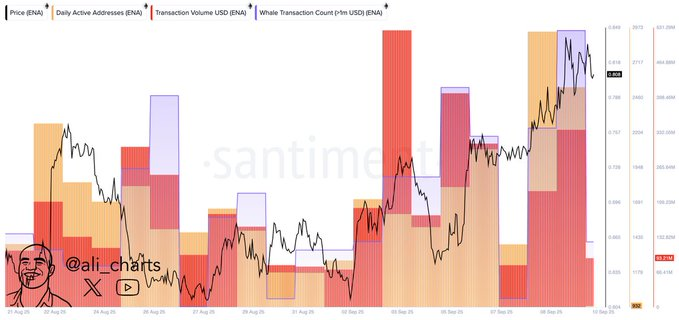

- Ethena ($ENA) active addresses, transaction volume, and whale transactions have all risen in tandem with recent price advances.

- Short-term consolidation is visible, with $0.770–$0.775 serving as an important support range for bullish traders.

- Elevated long/short ratios reflect strong bullish sentiment but increase exposure to possible liquidations if price weakens.

Ethena is a project with a history of on-chain activity growth and balanced market results, which happens to be backed by both rising participation and growing transaction value, as well as the presence of whales, which correlates with price stability amid short-term changes..

On-Chain Activity Signals Growth

Ali (@ali_charts) shared data showing Ethena’s daily active addresses, transaction volume, and whale transactions moving upward in parallel. This alignment suggests deeper engagement across the network rather than temporary wallet spikes.

Daily active addresses started climbing from late August, reflecting expanding participation and growing demand for Ethena ($ENA). The rise indicates not only broader adoption but also consistent engagement, which strengthens overall market structure.

Transaction volume in USD has advanced alongside active address growth. This suggests that higher-value transactions are driving the network, showing users are transacting with more meaningful amounts rather than creating low-value activity.

Whale Activity and Market Participation

Whale transaction counts have shown sharp surges during periods of price movement. Such activity often reflects accumulation phases rather than distribution, strengthening confidence in longer-term market sustainability.

The data also show whales remaining active at higher price levels, which suggests conviction in maintaining positions. This indicates that large holders are adding liquidity during consolidation phases instead of exiting their trades.

Each price advance was supported by spikes in whale activity, reinforcing the trend that whales are aligned with network growth. The coordination between retail activity and whale accumulation provides a stronger base for future rallies.

Price Outlook and Market Positioning

Ethena ($ENA) traded between $0.765 and $0.785 in the past 24 hours, closing at $0.773 with a daily change of -1.37%. Despite this, the token delivered a 7-day gain of +19.15%.

Performance remains robust with a 90-day gain of +157.32% and 1-year growth of +264.38%, even though the year-to-date figure is at -14.92%. This blend of volatility and resilience shapes Ethena as a high-potential asset.

The Binance ENA/USDT long/short ratio of 2.7092 and OKX ratio near the same level show traders are heavily positioned long. This reveals strong optimism but also a risk of liquidations should the market reverse.