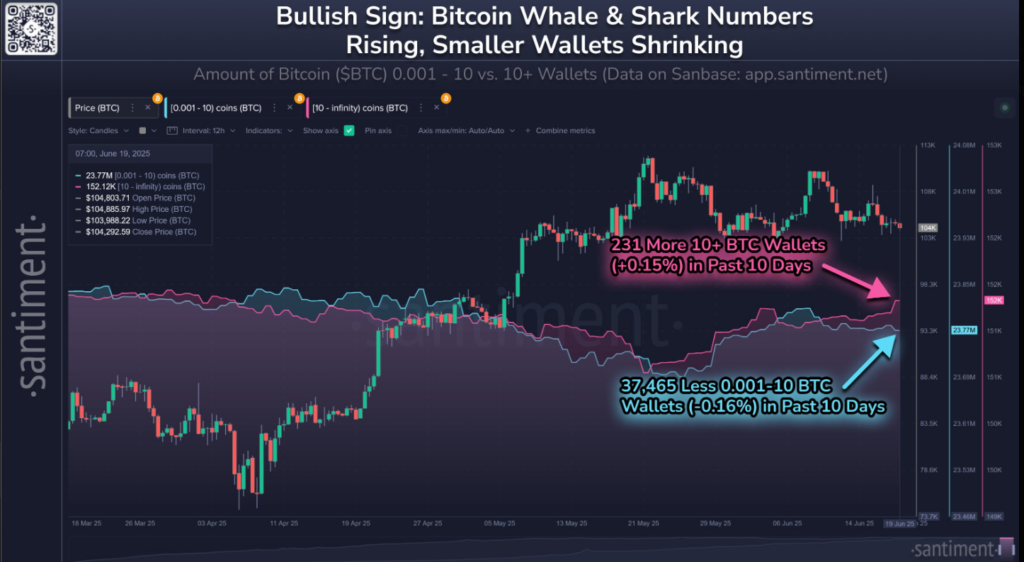

- Wallets holding 10+ BTC rose by 231 in 10 days, signaling institutional confidence.

- Over 37,000 small wallets exited the market, reflecting growing caution among individual investors.

- BTC dropped 0.56% in 24 hours, with volume down nearly 8%, indicating subdued market activity.

Bitcoin’s market dynamics are undergoing a pivotal shift as institutional giants quietly accumulate while retail investors step back. With the price hovering just above $103K, recent wallet activity reveals a growing divide between seasoned whales and cautious individual holders. This divergence is stirring talk of a potential bullish setup, as historical trends favor accumulation by large players during market lulls. Amid this quiet redistribution, all eyes are on whether Bitcoin is gearing up for its next major breakout.

Institutional Wallets Grow as Retail Confidence Fades

As Santiment observes, there is a dichotomy between high-investor and small-scale retail activity in Bitcoin wallets recently. In the last 10 days alone, the number of wallets with 10+ BTC also rose notably by 231 wallets or a 0.15% increase. Such a pattern indicates that the whales and the sharks are accumulating once again when the market value of Bitcoins is hanging on the tip of $104.3 K. In the past, such actions of high-capacity addresses usually pointed to the prospects of a long-term expansion and were considered as the precursors of a bullish mood returning to the venue.

Smaller retail wallets that store between 0.001 and 10 BTC, on the other hand, have experienced a steep decline in this period, and it has declined by 37,465 units in the same period, a -0.16 percent fluctuation. This fall can be the weakening of confidence or profit-taking by individual investors as a reaction to the volatility in the market.

This contrast can be interpreted readily by analysts as a strategic redistribution stage: small players reduce as the large ones amass it, so there is a possibility of a rise in the price of Bitcoin. Provided that the pattern of previous history is not broken, this divergence may become the precursor of the next bullish restoration of crypto markets.

Bitcoin price trading above $103K despite the short-term dip

However, as of June 21, Bitcoin is selling at $103,533.13, representing a minor dip of 0.56% in the last 24 hours, as per CoinMarketCap. The digital coin was heavily dropped from the high of the day at $105.46K and momentarily dropped to almost below the $102K mark and later went back to balance at the $103.6K mark.

The active trading volume has also declined by 7.79% to stand at $40.52 billion, which is a possible indicator of a less active market during consolidation in terms of pricing. Although Bitcoin experiences a short-term downfall, it still has a strong market cap of 2.05 trillion with a circulation supply of 19.88 million BTC, nearly half of its limited supply of 21 million coins.