- Tron leads in stablecoin inflows, gaining $1.04B in 7 days, surpassing Ethereum, and signaling strong liquidity demand in DeFi.

- Tether’s $1B mint on Tron coincided with Bitcoin’s surge to $107,500, underscoring the impact of liquidity injections on BTC’s price.

- Despite a $2B lending TVL drop, TRX price climbs, driven by stablecoin flows shifting into staking and DEX activity on the network.

Stablecoin flows have decisively shifted toward Tron, marking it as the top destination for digital dollar capital in the last seven days. The network attracted $1.04 billion in USDT and USDC net inflows, overtaking Ethereum and setting a strong bullish tone for its DeFi positioning. Ethereum followed with $776 million, maintaining its institutional-grade status but trailing Tron’s momentum.

<embed> https://x.com/RoundtableSpace/status/1932131831312240669 <embed/>

According to a post by Mario Nawfal referencing Lookonchain data, Solana faced a sharp outflow of $99 million in stablecoins during the same period. This significant divergence suggests a reallocation of capital, as investors seek faster, cheaper chains with deeper liquidity pools. Avalanche, Polygon, and Arbitrum saw respectable inflows, but none matched Tron’s magnitude.

The surge in stablecoin volume on Tron signals increasing trust from whales and institutional players. These movements typically precede market expansion phases, especially in lending and yield-generating protocols where fresh liquidity amplifies user activity and TVL metrics.

Tether’s Billion-Dollar Minting on Tron Triggers Bitcoin Surge

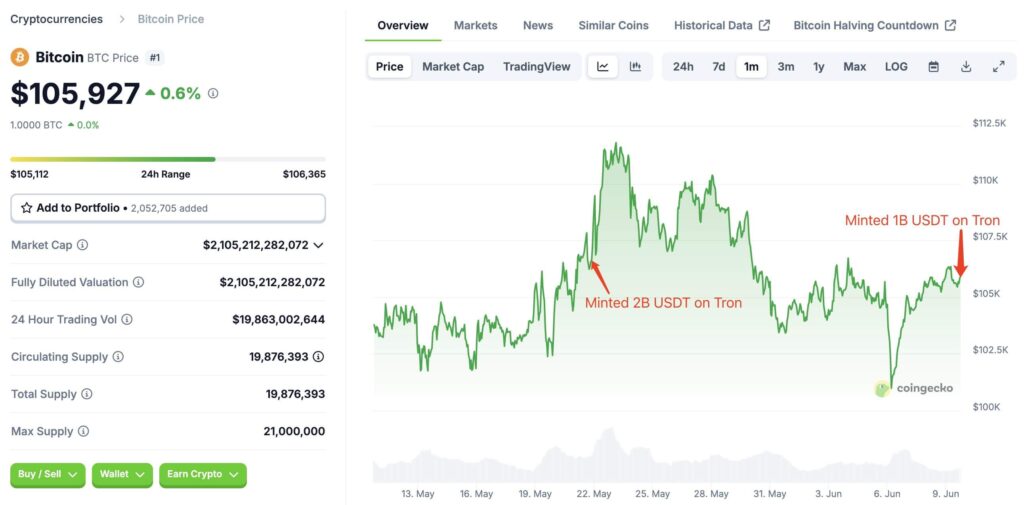

A report by Lookonchain confirms that on June 9, Tether minted one billion USDT directly on the Tron blockchain. The issuance comes just weeks after a previous $2 billion USDT mint on May 21, which aligned perfectly with Bitcoin’s explosive rally past $111,000. This timing once again highlights how fresh stablecoin supply drives short-term crypto price action.

Lookonchain tracked structured on-chain activity between Tether’s multisig wallet, treasury, and a burn address, suggesting these aren’t random movements. Roughly 10 billion USDT has been shuffled in recent weeks, with 1.5 billion sent to Bitfinex—a move consistent with liquidity provisioning across centralized exchanges.

Bitcoin’s response was immediate. Prices jumped from $104,000 to $107,500 shortly after the June 9 mint, following the same bullish pattern seen in May. This reinforces the growing view that Tron’s USDT activity is a direct driver of BTC rallies.

Lending TVL on Tron Drops $2 Billion Despite TRX Strength

João Wedson shared that lending protocols on Tron shed nearly $2 billion in TVL in recent days, bringing a bearish undertone to the otherwise bullish narrative. Yet, TRX defies this trend, with its price climbing past $0.26, hinting at a decoupling between lending activity and token valuation.

Historically, drops in lending TVL on Tron have preceded price surges for TRX. This may reflect a rotation of capital toward other DeFi sectors like staking or DEX trading. Lending contracts, staking pools, and liquidity platforms may be absorbing the fresh stablecoin inflows, keeping the network vibrant.

Despite lending volatility, Tron holds around $5 billion in TVL. Paired with heavy stablecoin inflows, consistent USDT issuance, and bullish Bitcoin reactions, Tron’s dominance in crypto liquidity is solidifying. Solana, in contrast, faces headwinds amid persistent capital flight.